Exploring the Key Features of an Offshore Trust for Wide Range Administration

Offshore trust funds have actually obtained interest as a strategic tool for riches administration. They offer distinct advantages such as property security, tax obligation optimization, and boosted personal privacy. These trusts can be tailored to fulfill certain economic purposes, safeguarding assets from prospective threats. There are crucial considerations to keep in mind - Offshore Trust. Recognizing the ins and outs of offshore depends on may expose even more than just benefits; it could uncover potential difficulties that warrant cautious thought

Understanding Offshore Trusts: A Primer

Offshore depends on may seem complex, they serve as beneficial financial tools for individuals looking for to handle and secure their wide range. An offshore count on is a legal arrangement where a person, called the settlor, transfers properties to a trustee in a foreign jurisdiction. This framework permits boosted personal privacy, as the information of the count on are commonly confidential and not subject to public analysis. Additionally, offshore trusts can offer flexibility pertaining to possession administration, as trustees can be picked based upon experience and administrative benefits. They can likewise be customized to fulfill certain financial objectives, such as estate preparation or tax obligation optimization. Comprehending the legal and tax effects of overseas counts on is essential, as regulations differ substantially across different countries. On the whole, these trust funds provide a calculated approach to wealth management for those wanting to navigate complicated financial landscapes while enjoying particular benefits that residential counts on might not give.

Property Protection: Shielding Your Wide range

Property protection is an important consideration for individuals looking for to secure their riches from prospective legal cases, creditors, or unanticipated economic setbacks. Offshore trust funds offer as a calculated device for accomplishing this goal, providing a layer of security that domestic possessions might lack. By moving assets right into an offshore depend on, people can produce a legal barrier in between their wealth and potential complaintants, successfully protecting these properties from suits or bankruptcy proceedings.The jurisdiction of the offshore depend on typically plays an essential function, as numerous nations provide robust lawful frameworks that safeguard count on properties from external cases. In addition, the anonymity supplied by offshore depends on can additionally hinder financial institutions from pursuing cases. It is important for people to recognize the certain legislations regulating asset protection in their chosen territory, as this expertise is essential for making the most of the efficiency of their wealth monitoring techniques. Generally, overseas depends on stand for an aggressive approach to maintaining wealth versus uncertain economic obstacles.

Tax Obligation Benefits: Navigating the Fiscal Landscape

Offshore depends on use considerable tax obligation advantages that can boost wealth administration strategies. They provide chances for tax obligation deferral, permitting properties to grow without immediate tax implications. Furthermore, these depends on might offer estate tax advantages, additionally enhancing the economic legacy for beneficiaries.

Tax Deferment Opportunities

Just how can individuals utilize offshore depend make best use of tax deferral chances? Offshore trust funds use a critical avenue for postponing taxes on income and funding gains. By putting assets in an offshore trust, individuals can take advantage of jurisdictions with beneficial tax regimens, enabling prospective deferment of tax liabilities till distributions are made. This system can be especially useful for high-income earners or capitalists with substantial capital gains. In addition, the income produced within the trust might not undergo immediate taxes, allowing riches to grow without the concern of yearly tax obligation obligations. Guiding via the complexities of worldwide tax obligation legislations, people can properly make use of offshore depend boost their riches management approaches while reducing tax obligation direct exposure.

Inheritance Tax Conveniences

Privacy and Discretion: Keeping Your Affairs Discreet

Preserving privacy and discretion is essential for individuals seeking to safeguard their riches and possessions. Offshore depends on use a durable framework for guarding individual info from public scrutiny. By establishing such a count on, people can efficiently divide their individual events from their financial rate of interests, ensuring that sensitive information stay undisclosed.The lawful structures regulating overseas counts on usually provide strong personal privacy defenses, making it hard for exterior celebrations to accessibility details without approval. This level of discretion is specifically interesting high-net-worth people worried regarding possible dangers such as lawsuits or undesirable interest from creditors.Moreover, the discrete nature of overseas territories boosts privacy, as these places commonly impose stringent policies surrounding the disclosure of depend on information. Subsequently, individuals can delight in the satisfaction that features recognizing their monetary approaches are secured from public expertise, consequently preserving their wanted degree of discretion in wealth monitoring.

Adaptability and Control: Customizing Your Count On Structure

Offshore trust funds supply significant adaptability and control, allowing people to tailor their trust fund structures to fulfill particular monetary and individual objectives. This flexibility allows settlors to select numerous aspects such as the sort of possessions held, circulation terms, and the visit of trustees. By selecting trustees who straighten with their values and goals, people can assure that their riches is my website taken care of based on their wishes.Additionally, offshore depends on can be structured to accommodate altering situations, such as variations in financial requirements or family members dynamics. This implies that recipients can get circulations at defined periods or under certain problems, providing further personalization. The capability to customize count on stipulations also ensures that the trust can develop in action to lawful or tax obligation modifications, preserving its performance with time. Eventually, this level of flexibility encourages individuals to produce a count on that aligns flawlessly with their lasting riches monitoring approaches.

Prospective Disadvantages: What to Think about

What difficulties might people deal with when taking into consideration an overseas depend on for wide range administration? While offshore counts on supply different benefits, they additionally feature potential downsides that call for cautious consideration. One significant concern is the cost connected with establishing and keeping such a count on, which can include legal costs, trustee costs, and continuous administrative costs. Additionally, people might run into complicated regulatory requirements that differ by territory, potentially making complex compliance and causing penalties otherwise stuck to properly. Offshore Trust.Moreover, there is an intrinsic danger of currency variations, which can affect the value of the possessions held in the trust. Trust fund beneficiaries may likewise deal with obstacles in accessing funds because of the management procedures involved. Public perception and potential examination from tax authorities can produce reputational risks. These elements necessitate complete research study and specialist support before waging an offshore trust for wealth management

Key Considerations Before Establishing an Offshore Trust

Prior to establishing an overseas depend on, individuals must take into consideration a number of crucial elements that can significantly influence their riches monitoring technique. Legal jurisdiction ramifications can affect the trust fund's performance and compliance, while taxation considerations may influence overall benefits. A comprehensive understanding of these components is important for making educated choices pertaining to overseas trusts.

Legal Territory Ramifications

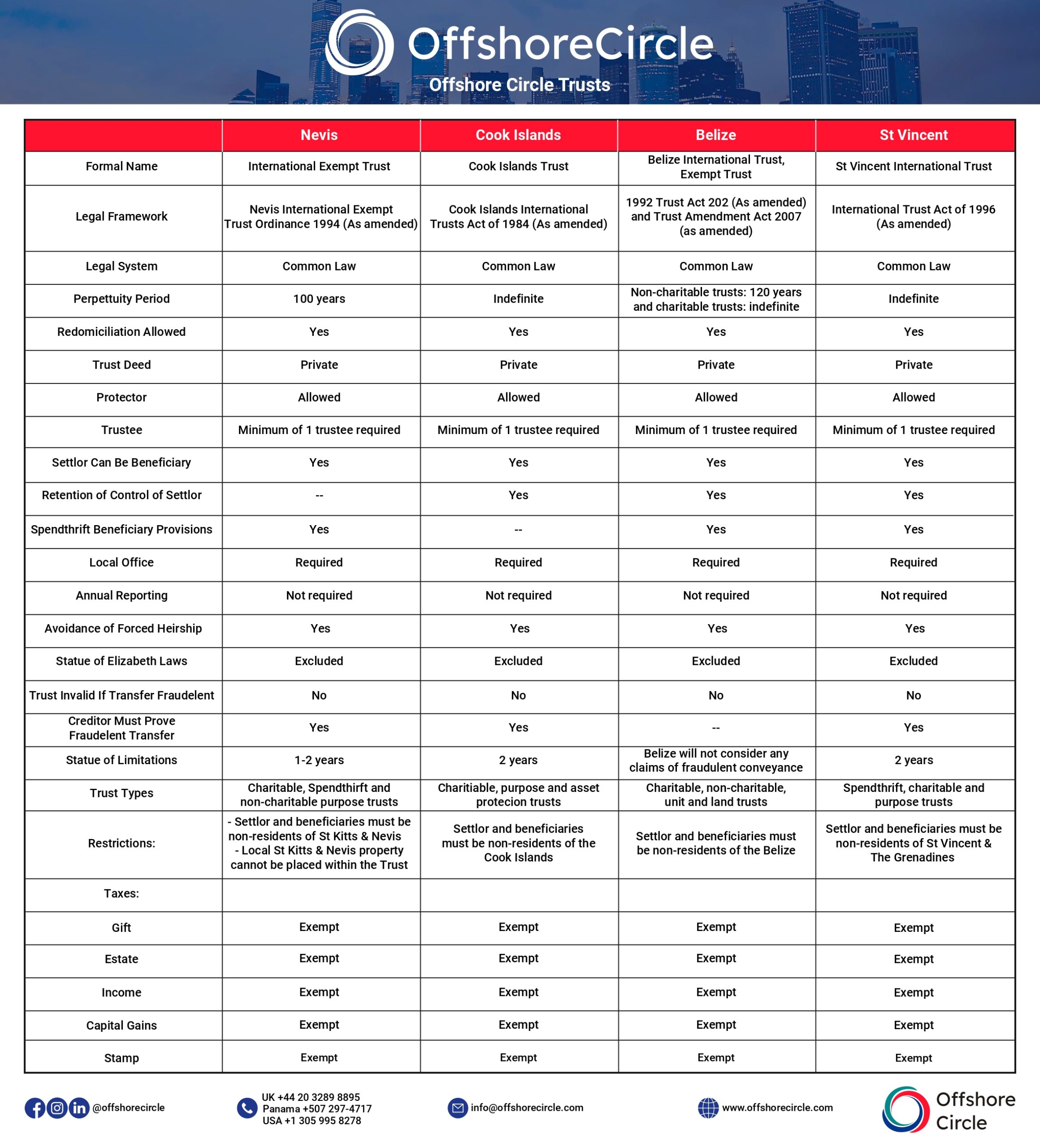

When considering the facility of an offshore trust fund, the selection of legal territory plays a critical duty fit the trust fund's effectiveness and safety and security. Various jurisdictions have differing legislations governing trust funds, including guidelines on property protection, privacy, and compliance with worldwide criteria. A territory with a robust lawful structure can enhance the count on's authenticity, while those with much less rigid regulations might posture dangers. Additionally, the online reputation of the chosen jurisdiction can impact the count on's perception amongst beneficiaries and monetary establishments. It is essential to examine aspects such as political security, legal precedents, and the accessibility of seasoned fiduciaries. Ultimately, selecting the appropriate territory is essential for achieving the preferred goals of possession protection and wealth management.

Tax Considerations and Conveniences

Tax considerations substantially affect the choice to develop an offshore trust. Such trusts may offer substantial tax benefits, consisting of minimized earnings tax liability and possible inheritance tax benefits. In lots of territories, revenue generated within the trust can be strained at lower rates or otherwise whatsoever if the beneficiaries are non-residents. Additionally, assets kept in an overseas depend on may not go through domestic inheritance tax obligations, promoting wide range conservation. Nevertheless, it is vital to browse the complexities of international tax legislations to guarantee compliance and avoid challenges, such as anti-avoidance guidelines. People should seek advice from tax obligation professionals experienced in overseas frameworks to optimize advantages while sticking to suitable regulations and guidelines.

Regularly Asked Questions

Just how Do I Choose the Right Jurisdiction for My Offshore Trust fund?

Picking the best territory for an overseas count on involves evaluating aspects such as lawful stability, tax implications, regulative setting, and personal privacy laws. Each jurisdiction provides unique benefits that can considerably influence riches management methods.

Can I Modification the Recipients of My Offshore Depend On Later On?

The capability to transform recipients of an offshore trust depends on the count on's terms and jurisdictional legislations. Typically, many offshore counts on enable alterations, however it is crucial to get in touch with lawful advice to guarantee my website compliance.

What Is the Minimum Quantity Needed to Establish an Offshore Trust?

The minimum amount needed to develop an overseas trust varies substantially by jurisdiction and service provider. Commonly, it ranges from $100,000 to $1 million, depending upon the intricacy of the trust fund and associated charges.

Exist Any Kind Of Legal Limitations on Offshore Depend On Investments?

The legal constraints on overseas count on financial investments differ by territory. Normally, policies might limit specific possession types, enforce reporting demands, or restrict deals with specific nations, guaranteeing conformity with global legislations and anti-money laundering procedures.

How Do I Dissolve an Offshore Count On if Needed?

To liquify an offshore count on, one must follow the terms described in the count on action, ensuring conformity with relevant regulations. Legal recommendations is usually advised to browse prospective complexities and ascertain all commitments are satisfied. By transferring assets right into an overseas trust, people can produce a lawful barrier in between their riches and prospective complaintants, successfully shielding these properties from suits or personal bankruptcy proceedings.The territory of the offshore trust typically plays an important function, as lots of countries supply robust lawful frameworks that safeguard trust fund assets from Click This Link exterior claims. By developing such a trust fund, people can successfully divide their personal affairs from their economic passions, ensuring that delicate details remain undisclosed.The legal structures regulating offshore trusts often give strong privacy securities, making it challenging for external celebrations to accessibility information without approval. Offshore trust funds supply considerable flexibility and control, enabling people to customize their depend on structures to satisfy particular monetary and individual goals. When taking into consideration the facility of an offshore trust, the choice of lawful jurisdiction plays a crucial role in shaping the count on's performance and safety. The ability to change beneficiaries of an offshore trust depends on the count on's terms and jurisdictional legislations.

Comments on “The Role of Trustees in an Offshore Trust: Key Responsibilities”